Hire Purchase

Hire Purchase

Hire Purchase spreads the cost of an asset over a fixed period. It provides fixed monthly repayments so you can manage your budget effectively over the repayment term. When the term finishes, you own the asset.

Fixed-rate Hire Purchase lets you fund a business asset over 12-84 months, depending on the asset type. The title to the asset passes to you on receipt of the final rental payment.

The interest rate is fixed for the finance term to make budgeting and managing your cash flow more predictable. Repayments include both capital and interest and are made either monthly or quarterly. Repayment can be structured on a seasonal repayment profile to meet the peaks and troughs in your cash flow, allowing for smaller loan payments during the lower revenue months and larger amounts during higher revenue months.

Finally, the asset may be claimed against your taxable profit under capital allowances, an advantageous tax benefit that should be explored.

Key Benefits

- Fixed monthly or quarterly repayments

- Fixed-rate of interest

- You can reclaim the VAT element of the acquisition via HMRC (See VAT Deferral Section)

- Seasonal repayment options

- Tax benefits of ownership

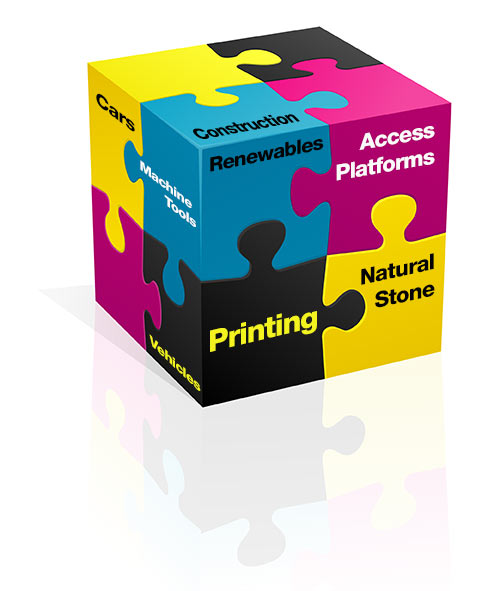

Alternative options to Hire Purchase may provide a better solution for your business finance needs. Sheppex will always aim to find the best terms on offer to borrowers, and it is easy to find out more about the different forms of business finance by contacting us.

Other forms of business finance from Sheppex:

- VAT Deferral

- Finance Lease

- Operating Lease

- Capital Release

- Commercial Load / Soft Asset Loan

- Invoice Finance

For more information or to apply, don’t hesitate to get in touch with us on 01959 565 000.

“We had dealt with other finance providers before, but they did not have the experience that Sheppex has, nor did other providers have a detailed understanding of our equipment and resale values at the end of the loan term, which slowed the whole process down,”

Nick Lindwall, Ottimo Digital co-founder and Director

Click to find out how hire purchase helped Ottimo