Capital Release

Capital Release

Unlock low-cost working capital from your business assets! Capital release uses the value in existing business assets to provide working capital, fund a deposit for new machinery, or help with infrastructure costs.

Capital Release – or Refinancing – means a business can access the equity in existing business assets.

For example, you can use an unencumbered asset, such as machinery already purchased. But you can also choose to refinance assets on an existing finance agreement.

Capital Release is suitable for companies of all sizes, including sole traders.

If you need cash for your business, find out how much you could release by contacting us here at Sheppex.

We have decades of business finance experience and have access to a range of lenders for all business types, including small, medium-sized and large businesses. This allows Sheppex to compare a broad range of lenders to find the best value terms for our clients.

How does it work?

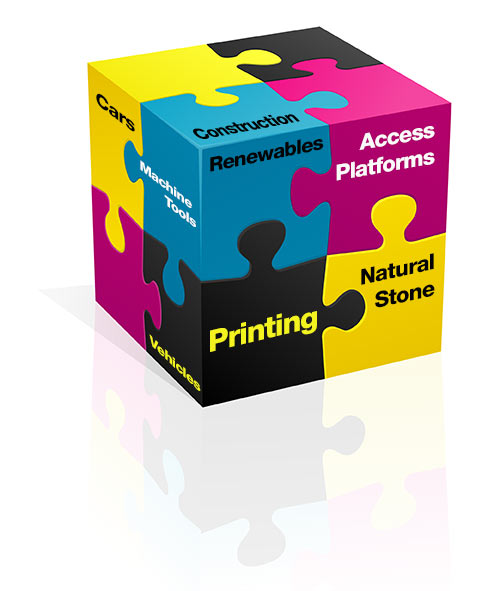

The ‘type’ of capital used for capital release usually includes plant and machinery – we will talk you through valuing existing business assets and raising working capital.

You can use Capital Release for:

- Reducing existing payments

- Raising working capital

- Funding restructuring costs

- Finance a new investment

- Funding Company Mergers / Acquisitions / Management Buyouts

Key benefits

- Capital Release is suitable for companies of all sizes, including sole traders.

- You keep control of your assets and use them as usual.

- Existing finance agreements can be replaced and terms renegotiated.

- Care and Consideration: Sheppex will always act as fast as possible on behalf of clients, but we also take time to explain the detail and your obligations fully.

Other forms of business finance from Sheppex:

- Hire Purchase

- VAT Deferral

- Finance Lease

- Operating Lease

- Commercial Loan / Soft Asset Loan

- Invoice Finance

To learn more about Capital Release or apply, please get in touch with us on 01959 565 000.

Sheppex Limited is a specialist Asset Finance company offering competitive and flexible financial solutions.

The directors and our financial specialists have in-depth knowledge and understanding of manufacturing industries. They can tailor finance facilities to assist with acquiring new or used plant and machinery.