Case Study: Refinancing for Business Growth

March 7, 2025A one stop print business based in the South East required a capital injection to fund further growth, read how refinancing an existing piece of equipment came into play.

Background:

Our client a print business based in the South East recently invested in a new printer that significantly improved productivity and reduced outsourcing costs. Encouraged by this operational turnaround, the company sought to expand further by investing in additional sales staff and making improvements to their studio. However, securing the necessary funding proved to be a challenge. To explore their options, they consulted our Print Specialist Team to determine the best financial strategy to support their growth.

Solution:

Solution:

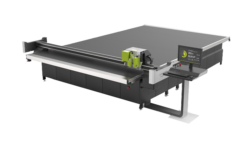

After our team reviewed their financial position and goals, Sheppex recommended refinancing an existing asset to free up capital. The company had a 2019 Summa F1612 that could be leveraged for funding. Sheppex arranged a refinancing agreement of £25,000 over a 48-month term, enabling the business to access the necessary funds while maintaining manageable repayments.

This strategic move provided the company with the liquidity to invest in additional sales staff and studio enhancements without putting pressure on their cash flow. latest asset finance facility provided by Sheppex secured a new state of the art Kongsberg C64 Cutter and a Mimaki UCJV 300-160 digital printer to replace existing machines.

Key Highlights:

- Refinancing an existing asset: Utilised the 2019 Summa to secure funding

- Terms: £25,000 over 48 months, a structured repayment plan to maintain financial stability

- Growth-focused approach: leveraging assets to fuel business development

Conclusion:

Through refinancing, this printing company successfully unlocked the funds required to expand their team and enhance their studio, ensuring continued business growth. With Sheppex’s guidance they were able to secure financing in a cost-effective manner, demonstrating how refinancing can be a valuable tool for businesses looking to invest in their future.

This strategic financial decision positioned the company for long-term success in an increasingly competitive industry.