VAT Deferral

VAT Deferral

Paying VAT upfront when buying an asset or piece of equipment can put pressure on cash flow. A short-term loan, usually for up to three months, defers this VAT payment and helps you manage your cashflow. The loan is repaid in full once the VAT is reclaimed from HMRC.

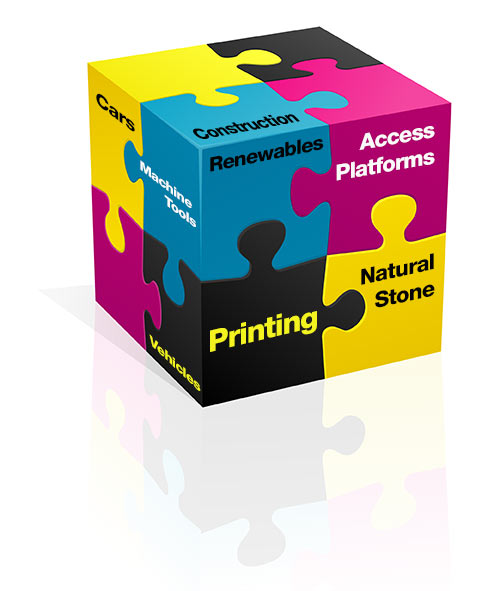

VAT is usually required to be paid upfront when securing Hire Purchase (HP) finance for assets such as new machinery, cars, construction and access equipment.

VAT deferral is a short-term loan that funds the VAT element of a new asset.

It can form part of a Hire Purchase agreement and is usually financed for a maximum period of 3 months to coincide with your VAT return and is repaid in full once the VAT has been reclaimed from HMRC.

On HP agreements, the VAT will be collected via direct debit at month 1, 2 or 3.

Key Benefits

- Relieve pressure on your cash flow.

- Can assist with securing a Hire Purchase agreement.

- Repaid in full once the VAT has been reclaimed.

Sheppex will always aim to find the best terms on offer to borrowers, and it is easy to find out more about the different forms of business finance, call the team on 01959 565 000.

Other forms of business finance from Sheppex: