Operating Lease

Operating Lease

Operating lease is a type of agreement allowing you to rent a business asset at a reduced fixed monthly or quarterly rental without the associated cost of depreciation. Title to the equipment remains with the finance company and at the end of term the equipment subject to the agreement can be either:

Returned to the finance company.

The rental agreement can be extended to allow continued use of the asset.

The equipment can be purchased at fair market value.

Key benefits

- The rentals are calculated including a residual value

- The liability can be charged to profit and loss and may be treated as “off balance sheet”

- Subject to your tax status the rentals can be offset against taxable profits

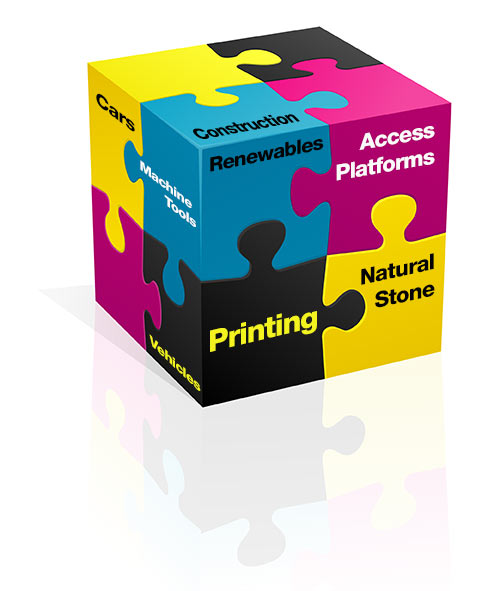

See our other products: