Finance Lease

Finance Lease

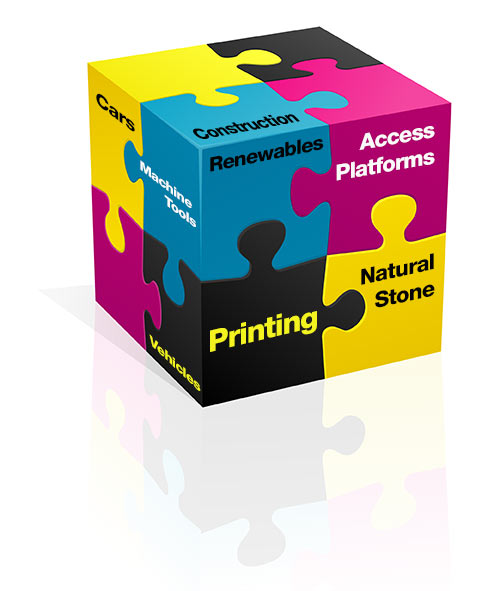

Finance leasing is a way for businesses to rent assets such as equipment or machinery without the need for a large upfront payment.

If you are considering purchasing or renting any vehicles for your business, our vehicle specialists have a wealth of experience in providing competitive terms on all vehicle types.

A Finance Lease is a rental agreement to use a business asset.

Rental agreement periods vary from 12-84 months on a fixed monthly rental.

You choose the right asset for your business, and Sheppex will tailor a Finance Lease facility to help acquire the asset, which could be new or used machinery.

The finance company purchases the asset and retains ownership. The hirer of the equipment must maintain and repair the asset.

At the end of the primary rental period:

- You can extend the rental agreement to continue using the asset

- You can return the equipment to the finance company and you (the hirer), can then choose to upgrade to the latest technology

- The asset can be sold to an independent third party, and the sale proceeds refunded to the hirer

Key benefits

- Fixed rentals for the whole agreement. Finance leasing spreads the cost (including interest charges) into fixed monthly or quarterly instalments over an agreed lease period.

- The equipment can be returned at the end of the term with no further liability.

- Flexible rental structure tailored to match your company’s cash flow.

- The asset will appear on the company balance sheet.

Other forms of business finance from Sheppex:

- Hire Purchase

- VAT Deferral

- Operating Lease

- Capital Release

- Commercial Loan / Soft Asset Loan

- Invoice Finance

To discuss your requirements, please get in touch with us on 01959 565 000.

Sheppex Limited is a specialist Asset Finance company offering competitive and flexible financial solutions.

The directors and our financial specialists have in-depth knowledge and understanding of manufacturing industries. They can tailor finance facilities to assist with acquiring new or used plant and machinery.